Strategies for Tackling Student Loans

Guest Post By: Faith Lyons

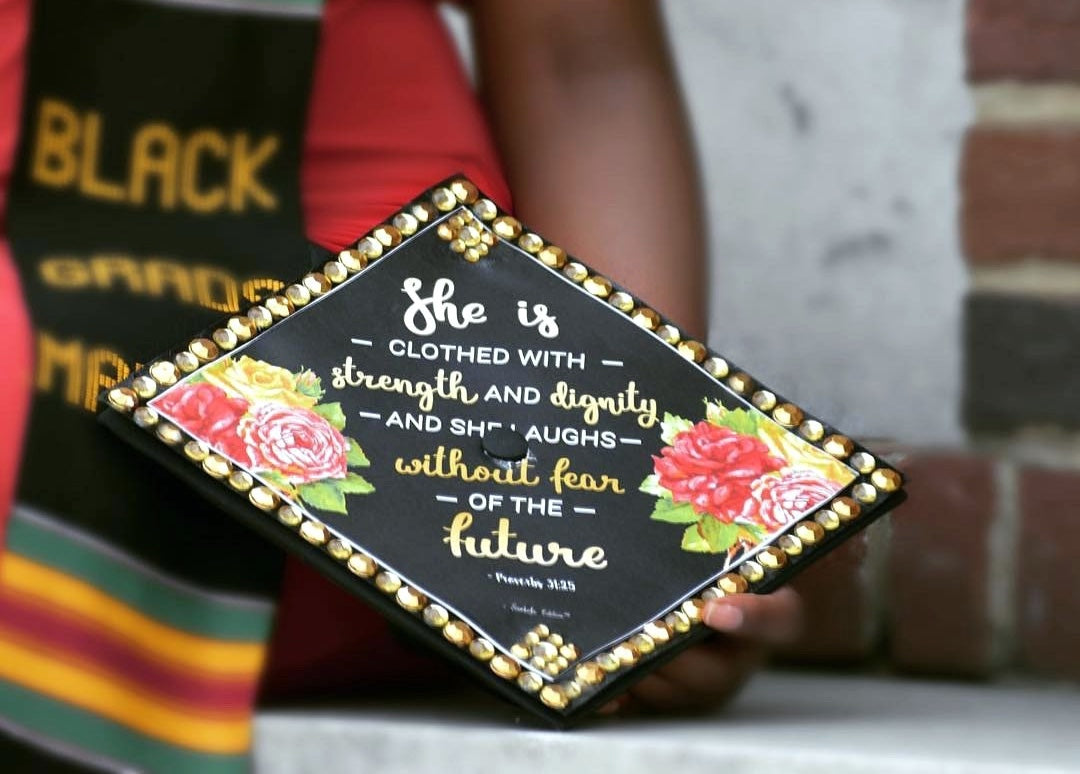

Picture this: graduation day was three days ago and you’re still on a natural high from the amazing speech that was given and the time of celebration that you’ve gotten to spend with friends and relatives; you’re so proud of yourself that you still have on your cap, gown, and stoles! You walk outside to go to your mailbox, with your head held high, grinning from ear to ear because nothing’s gonna bring you down! And that’s when it happens...BOOM! You get that anticlimactic student loan letter in the mail as to when repayment can begin; it hasn’t even been a week and the adulting begins to set in. Let’s discuss some ways that you can keep that smile on your face even after receiving such unfortunate hate mail, or in this case, mail we hate!

Educate Yourself!

Yeah, yeah I know, you just graduated or are about to and you know everything, but student loans are something that you want to make sure you understand and continue to learn about. Learn all that you can about the specific type of student loan that you have and don’t be afraid to read the frequently asked questions (FAQs) that are available on the websites as well as calling the toll-free numbers available to speak with a representative that can answer any questions that you have. There are a number of options pertaining to repayment plans; you want to make sure that you are familiar with each of them so that you can select one that will best fit your lifestyle. Additionally, there are repayment estimators/calculators available that can give you a good look at options for what a monthly payment plan will look like based on the type of loan you have and your income. The great thing is that there are very flexible loan repayment options that both are and aren’t based off of income, and information about loan consolidation if you have more than one loan, student loan forgiveness, and loan deferment and forbearance. Each option comes with its own set of pros and cons (which can be found here ), let’s use loan deferment and forbearance as an example. In regards to loan deferment and forbearance, you do have to request these options, be approved, and the interest does accumulate during the period of non-payment, however, such an option can help avoid student loan default .

Save, Save, Save!

Why put off for tomorrow what can be done today? Carefully assess and fully take advantage of the grace period that you have before payments are due after graduation, which is normally 6 months. Create a fresh and new budget for yourself for each pay period and trim the fat in regards to less important things that you find your money going towards. In adjusting your lifestyle during the grace period you will be surprised how much money you are able to put back as well as establishing a money-saving lifestyle that will develop into a healthy habit once it is time to start making payments. Although you may not be able to save or put back much (which is the reason you took out the student loan in the first place!), it doesn’t hurt to go ahead and open a savings or checking account that you will designate specifically for paying monthly toward your student loan. It also doesn’t hurt to put a few dollars into that account whenever you find yourself making a little extra money; whether it be from income tax, a monetary gift, yard sale, or if you’ve happened to find $5 on the sidewalk! This savings or checking account can later be linked to your student loan servicer where automatic payments can come out. In some cases loan lenders might even decrease the interest rate slightly for automatic monthly payments! Furthermore, starting a glass jar that you will collect change and one dollar bills in is another small way to save. Every little bit helps and certainly adds up!

Student loan debt is no fun at all and can be a real Debbie Downer after such a celebratory milestone such as graduating, but making a plan and setting realistic short term and long term goals on how you will combat such a financial mountain will certainly help in the long run. A few small tips that I would like to leave you with are to pay a little extra on the student loan when you can and are at a good, financially stable position, don’t be afraid to ask for help or wait until it’s too late if you are struggling, and last but not least, don’t be afraid to actively communicate with your lender in the form of phone calls and emails with any questions that you may have in regards to your payments and tweaking the amount of those payments if you need to. We will get through this together and our student loan debt won’t last forever! Much love and congratulations to the recent and up and coming graduates!

Faith Lyons is a graduating Business Administration student from Florida A&M University and Columbia Southern University who currently lives in North Florida. She is a first time mom and total fan girl that loves all things fashion, fun, and seafood! Her long term goals include starting her own fashion label and traveling the world with her daughter!

Follow Her: @FaithFangirl